[Rev. 1/24/2023 11:33:09 AM]

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, Page 157ê

LAWS OF THE STATE OF NEVADA,

PASSED AT THE

SPECIAL SESSION OF THE LEGISLATURE, 1867.

________

|

Chapter. I.–An Act to create certain Funds.

[Approved March 28, 1867.]

The People of the State of Nevada, represented in Senate and Assembly, do enact as follows:

Section 1. For the purpose of paying the salaries of the members and attaches of the present Legislature, the mileage of the members, and the incidental expenses of the same, the Treasurer of State is hereby authorized and required to set apart from the first moneys coming into the General Fund, the sum of twenty thousand dollars, which shall constitute a fund to be denominated “The State Legislative Fund.” The State Controller is hereby authorized and required to draw his warrants on said fund in favor of the members and attaches of the present Senate and Assembly, for mileage and compensation due, when duly certified to him in accordance with law. Sec. 2. The State Treasurer is hereby authorized and required to set apart from the first moneys coming into the “State Legislative Fund,” created by section first of this Act, the sum of four thousand dollars, two thousand five hundred dollars of which shall constitute the Contingent Fund of the Assembly, and one thousand five hundred dollars, the Contingent Fund of the Senate. The said Contingent Funds shall be under the exclusive control of the Senate and Assembly. Sec. 3. Any moneys that may remain in either of the funds created by this Act, upon the adjournment of the Legislature shall revert to the General Fund. |

State Legislative Fund created.

Contingent Funds.

To be under exclusive control of Senate and Assembly. Money remaining to revert to General Fund. |

________

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 158ê

|

Treasurer required to pay Geo. F. Jones & Co., etc.

Act to take effect.

Certificate.

Certificate. |

Chap. II.–An Act providing for the payment of certain indebtedness due certain parties from the City of Virginia.

The People of the State of Nevada, represented in Senate and Assembly, do enact as follows:

Section 1. The Treasurer of the city of Virginia is hereby required, from the first moneys now in or coming into and belonging to the “Virginia City Redemption Fund,” created and provided for in the Act entitled “An Act to provide for the payment of the outstanding indebtedness of Virginia, Storey County,” approved January twenty-seventh, one thousand eight hundred and sixty-five, to pay George F. Jones & Co. the full sum of principal and interest due at the time of payment, upon the warrant or order number seven hundred and eighteen, draw [drawn] upon the City Treasurer of said city by Charles Rawson, Clerk, January second, one thousand eight hundred and sixty-three, in favor of George F. Jones & Co., according to the tenor and effect thereof, and to pay to all other holders of any and all warrants, orders, or other evidences of indebtedness for cash loaned the city of Virginia, the full amount due thereon, both principal and interest, at the time of such payment, and pay the same in the order of the issuance thereof. Sec. 2. This Act shall take effect and be in force from and after its passage.

This is to certify that Assembly Bill 77, “An Act providing for the payment of certain indebtedness due certain parties from the city of Virginia,” passed the Assembly on the 26th day of March, A.D. 1867, notwithstanding the objections of the Governor, by the following vote: Yeas, 26; Nays, 6. R. D. Ferguson, Speaker of the Assembly. A. Whitford, Clerk of the Assembly.

This is to certify that Assembly Bill No. 77, “An Act providing for the payment of certain indebtedness due certain parties from the city of Virginia,” passed the Senate this day, notwithstanding the objections of the Governor, by the following vote: Yeas, 13; Nays, 3. James S. Slingerland, President of the Senate. John R. Eardley, Assistant Secretary of the Senate. |

________

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 159ê

|

Chap. III.–An Act to amend an Act entitled “An Act to provide Revenue for the support of the Government of the State of Nevada,” approved March 9th, 1865, as amended by an Act entitled “An Act to amend an Act entitled ‘An Act to provide Revenue for the support of the Government of the State of Nevada,’ approved March 9th, 1865,” approved February 24th, 1866.

[Approved April 2, 1867.]

The People of the State of Nevada, represented in Senate and Assembly, do enact as follows:

Section 1. Section one of said Act is hereby amended, so as to read as follows: Section One. An annual ad valorem tax of one hundred and twenty-five cents upon each one hundred dollars’ value of taxable property is hereby levied and directed to be collected and paid, for State purposes, upon the assessed value of all taxable property in this State, including the proceeds of mines and the proceeds of mining claims, except such property as is by this Act exempted from taxation. Seventy cents of said tax on all property, other than proceeds of mines and mining claims, is and shall be held to be the same as that levied under the provisions of an Act to amend an Act entitled “An Act authorizing a State Loan, and levying a tax to provide means for the payment thereof,” approved February 6th, A.D. 1867, and the money coming into the State Treasury from said tax to the extent of seventy cents on all property, except proceeds of mines and mining claims, shall be applied exclusively to the payment of the principal and interest of the bonds provided to be issued by the last mentioned Act. Twenty-five cents of the one hundred and twenty-five cents levied under the provisions of this Act is hereby appropriated to the payment of Territorial indebtedness, funded under the provisions of an Act entitled “An Act to provide for carrying out in part the provisions of Section seven, Article seventeen, of the Constitution of the State of Nevada,” approved February 14th, 1865, which shall be applied exclusively to the extinguishment of such funded debt. Five cents of the one hundred and twenty-five cents by this Act levied, including the tax levied on the proceeds of mines and mining claims, is hereby set apart for the support and maintenance of a State University and Common Schools; and ninety-five cents of the one hundred and twenty-five cents levied on the proceeds of mines and mining claims, and twenty-five cents of the one hundred and twenty-five cents hereby levied on other property than proceeds of mines and mining claims, is hereby set apart for general revenue purposes. All assessments and valuation of property for taxable purposes shall be made on the value thereof in legal tender paper currency of the United States. Sec. 2. Section two of said Act is hereby amended, so as to read as follows: Section Two. The Board of County Commissioners of each county shall, prior to the first Monday of April of each year, cause to be prepared suitable and well bound books for the use of the Assessor, in which the County Assessor shall enter his tax list and assessment roll, as hereinafter provided; and in which list and assessment roll shall be assessed and included all taxes levied by authority of law for county purposes. |

Taxes levied for State purposes.

Books for use of Assessor. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 160 (CHAPTER 3)ê

|

Assessment of ores and minerals.

Quarterly Assessment Roll, how arranged. |

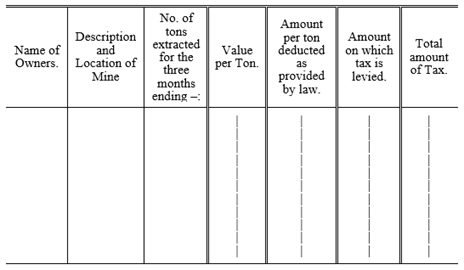

assessed and included all taxes levied by authority of law for county purposes. Said books shall contain suitable printed heads, and be ruled to conform with the form of the assessment roll, as provided by this Act. Sec. 3. Section ninety-nine of said Act is hereby amended, so as to read as follows: Section Ninety-nine. All ores and minerals shall be assessed for purposes of taxation for State and county purposes at their value when severed from the mine and deposited on the surface; and to determine the value of ores containing gold and silver, or either, the Assessor shall deduct from the gross yield of such ores, when the same are worked by any process without roasting, the sum of eighteen dollars per ton; and when worked by the Freiburg or roasting process, or by smelting process, the sum of forty dollars per ton. Sec. 4. Section one hundred and six is hereby amended, so as to read as follows: Section One Hundred and Six. It shall be the duty of the Assessor to prepare and complete quarterly, on or before the second Monday in February, May, August, and November, in each year, a tax list or assessment roll, which shall be known and designated as the “Assessment Roll of the Proceeds of Mines,” alphabetically arranged in a book or books furnished him by the Board of County Commissioners for that purpose, in which book or books shall be listed or assessed the proceeds of all the mines in his county, as provided in this Act, and in such book or books he shall set down in separate columns: First.-The names of the owners, firms, incorporated companies, or associations engaged in the business of extracting ores, quartz, or minerals bearing gold and silver, or either; and if any owner, firm, incorporated company, association, or superintendent shall refuse to make the statement, or refuse to the Assessor or his deputy access to their books as provided in this Act, that fact shall be noted under his name, opposite the name of the owner, firm, incorporated company, or association. The Assessor shall, as particularly as practicable, give a description of the mine or mining claim from which the ores, quartz, or mineral assessed was extracted or taken. Second.-The number of tons of gold and silver, or either, bearing ores, quartz, or minerals extracted by such owners, firms, incorporated companies or associations, for the preceding quarter year. Third.-The assessed value per ton; provided, that ores, quartz, or minerals containing gold and silver, or either, which yield less per ton than is by this Act directed to be deducted for expenses of working the same, shall not be assessed or included in the assessment roll, but shall be included in the statement furnished the Assessor. Fourth.-The total assessed value. Fifth.-The amount, after the deductions as provided in this Act, upon which such taxes are levied. The form of the quarterly assessment roll shall be substantially as follows: |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 161 (CHAPTER 3)ê

|

QUARTERLY ASSESSMENT ROLL OF THE PROCEEDS OF THE MINES FOR THE QUARTER ENDING _________________:

Any person, firm, incorporated company, or association, feeling aggrieved on account of an assessment made as in this statute provided, may appear before the Board of County Commissioners at any regular or special term thereof, and ask to have such assessment equalized; and such Board may proceed to hear the allegations of the party complaining, and of the Assessor, and such other evidence as may be produced, and by an order entered in the minutes of their proceedings, equalize such assessment by adding to or deducting therefrom, as may seem just, and such action when had shall be final. Sec. 5. Section one hundred and seventeen of said Act is hereby amended, so as to read as follows: Section One Hundred and Seventeen. The revenue arising from the tax of one hundred and twenty-five cents on the valuation of the proceeds of mines and mining claims, as fixed in this statute, shall be paid into the County Treasury, for the use and benefit of the State, to be appropriated as in this Act provided; and by the County Treasurer shall be paid over to the State Treasurer, as he is directed and required by law to pay over other moneys belonging to the State. Sec. 6. Section one hundred and eighteen is hereby amended, so as to read as follows: Section One Hundred and Eighteen. Every tax levied under the provisions or authority of this Act, on the proceeds of the mines, is hereby made a lien on the mine or mining claims from which ores, quartz, or minerals bearing gold and silver, or either, is extracted for reduction or removal; which liens shall attach on the first days of January, April, July, and October of each year, for the quarter year commencing on those days respectively, and shall not be satisfied or removed until the taxes as provided in this Act, on the proceeds of the mines, are all paid, or the possessory title to said mines or mining claims has absolutely vested in a purchaser under a sale for the taxes levied on the proceeds of such mines or mining claims. The County Assessor may at any time serve a notice, which shall be in writing, signed by him, upon any person or firm, or upon the superintendent, managing agent, foreman, or any person having charge or control of the business of any incorporated company or association engaged in reducing ores taken from any mine or mining claim, |

Form of Quarterly Assessment Roll.

Persons aggrieved may have assessment equalized.

Revenue, how paid over.

Tax levied, made a lien on mine or mining claim. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 162 (CHAPTER 3)ê

|

Compensation of Assessor and Auditor.

Compensation apportioned. |

from any mine or mining claim, setting forth the amount of taxes assessed and unpaid on account of ores or minerals extracted or taken from such mine or mining claim, and from the time of receiving such notice, the person or firm, incorporated company or association so notified shall be held liable for the amount of such unpaid taxes, to the extent of the value of the ores and minerals then in possession of the person or firm, incorporated company or association, extracted or taken from such mine or mining claim. Sec. 7. Section one hundred and nineteen is hereby amended, so as to read as follows: Section One Hundred and Nineteen. The Assessors in the several counties in this State shall be allowed to retain to their own use, for collecting the tax as provided in this Act, on the proceeds of the mines and mining claims, three per centum on all moneys by them collected, and no more. The Assessor and his deputies shall keep a correct account of the number of days and parts of days they have been actually employed in assessing the proceeds of the mines, as provided in this Act, and including therein the time employed in making the assessment for both State and county purposes on the proceeds of the mines; and shall verify the same under oath before the Clerk of the Board of County Commissioners, or other person authorized to administer oaths, and then present said account to the Board of County Commissioners, who, if satisfied of the correctness of the same, shall allow it, or so much thereof as they may find correct, and order payment thereof to be made at the rate of eight dollars per day, which shall be in full for all services in making the assessment for both State and county purposes, and shall be paid as in this statute provided. The County Auditor shall receive for extending the taxes on the Quarterly Assessment Roll of the Proceeds of the Mines, an amount not to exceed fifteen cents per folio of one hundred words. No County Treasurer shall be allowed to receive to his own use any per centage or compensation from the tax on the proceeds of the mines. Sec. 8. Section one hundred and twenty is hereby amended, so as to read as follows: Section One Hundred and Twenty. The amount allowed and paid out to the Assessor and County Auditor for services, under this Act, so far as it relates to the proceeds of the mines, shall be apportioned by the Auditor in the proportion the State tax bears to the county tax on proceeds of mines; and the amount shall be charged to the State and county, rateably in said proportion, and a verified statement of the amount allowed by the Board of County Commissioners shall entitle the Controller to credit the County Treasurer with such amounts as shall have been charged against the State. |

________

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 163ê

|

Chap. IV.–An Act supplementary to an Act entitled “An Act to provide Revenue for the support of the Government of the State of Nevada,” approved March 9, 1865, and the Acts amendatory thereof; and providing for levying and collecting Revenue for County purposes, and further prescribing the powers and duties of the Boards of County Commissioners of the several Counties of this State relative thereto.

[Approved April 2, 1867.]

The People of the State of Nevada, represented in Senate and Assembly, do enact as follows:

Section 1. The Board of County Commissioners of the several counties of this State, in addition to their other powers and duties, are hereby authorized and empowered to levy and cause to be collected and paid annually, in the manner provided by law for the assessment and collection of taxes for State purposes, an ad valorem tax for county purposes, not exceeding the sum of one hundred and fifty cents on each one hundred dollars’ value of all taxable property in the county, including the proceeds of mines and mining claims; provided, that in any county or counties in this State where the assessment roll of taxable property for the year A.D. 1866 exceeded in amount or value the sum of five millions of dollars, it shall not be lawful for the Board of County Commissioners of such county or counties, to levy on each hundred dollars’ value of taxable property in such county or counties, a higher rate of taxation for county purposes than one hundred and fifty cents; and, provided further, that in any such county or counties, as last herein specified, it shall not be lawful for the Board of County Commissioners to levy a tax for county purposes on the proceeds of the mines and mining claims in such county or counties, at a higher rate than twenty-five cents on each hundred dollars’ valuation thereof. Sec. 2. The Board of County Commissioners of each county are hereby authorized and empowered, annually, prior to the third Monday in April, unless otherwise provided by special Act, to levy and assess the amount of taxes that shall be levied for county purposes, designating the number of cents which shall, on each one hundred dollars of taxable property, be levied for each purpose; and shall add thereto the amount levied by law on each one hundred dollars of taxable property for State purposes; provided, however, that when the Board of County Commissioners levy any tax, they shall cause such levy to be entered on the records of their proceedings, and shall direct their clerk to deliver a certified copy thereof to the Auditor, Assessor, and Treasurer, each of whom shall file said copy in his office. The Board of County Commissioners of each county shall apportion the revenues coming into the county treasury under the provisions of this Act, after deducting the four per cent. as hereinafter provided, for the Treasurer’s Salary Fund, into such funds as are now or hereafter may be provided by law; provided, that the Board of County Commissioners are hereby authorized to set aside such portion of all the moneys of the county, to create a Redemption Fund for the payment of outstanding indebtedness, as is provided by any law now in force, or which may hereafter be passed. The Boards of County Commissioners of the several counties are hereby authorized and empowered, annually, to levy and collect such additional and special taxes as the statutes or laws of this State may authorize and require them to levy and collect. |

County Commissioners authorized to levy taxes for county purposes.

Taxes to be levied and assessed prior to the third Monday of April.

Revenues to be apportioned. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 164 (CHAPTER 4)ê

|

Additional taxes.

Assessment and collection of Co. taxes.

Lien.

Co. taxes on proceeds of mines, how assessed, etc.

Laws, to apply to taxes levied for county purposes.

Discount on quarterly payments.

Repeal. |

hereby authorized and empowered, annually, to levy and collect such additional and special taxes as the statutes or laws of this State may authorize and require them to levy and collect. Sec. 3. The assessment and collection of all taxes levied for county purposes, including the tax levied on the proceeds of mines and mining claims, shall be made at the same time, and in the same manner, and by the same officers, as is made the assessment and collection of taxes for State Purposes; and the assessment for county taxes shall be included in the same list and assessment roll taken and made for State taxes. All delinquent taxes, levied and assessed for county purposes, shall be included in any action brought against the same person and property, or either, for the recovery of delinquent taxes levied and assessed for State purposes. Sec. 4. Any tax levied by authority of law for county purposes is hereby made a lien against the property assessed, and a lien shall attach upon the real property for the tax levied upon the personal property of the owner of such real property; which lien shall attach on the third Monday in April in each year, and shall be as valid and binding in all respects as the lien of taxes levied and assessed for State purposes. Sec. 5. All taxes levied on the proceeds of mines and mining claims, for county purposes, shall in all respects be assessed and collected as taxes are levied and assessed on the proceeds of mines and mining claims for State purposes, and shall in like manner and effect constitute a lien on the possessory title or right to the mine or mining claim, against and upon which the same is assessed, until the taxes are paid. Sec. 6. All laws now in force in reference to the assessment and collection of taxes for State purposes, so far as applicable, are hereby made to apply to the assessment and collection of taxes levied and assessed for county purposes. Sec. 7. It shall be lawful for the Board of County Commissioners, by an order entered in their records or minutes of proceedings, to allow a discount to be made in favor of all persons who shall make payment ten days before the time when the same would become delinquent if not paid, of taxes levied and assessed, and required by law to be paid quarterly, for county purposes; but the rate of discount allowed shall not reduce the taxes so paid below the rate of seventy-five cents on each one hundred dollars’ value of the property assessed and taxed. A certified copy of such order, when made, shall be furnished by the Clerk of the Board to the collector of such taxes, and to the County Auditor, each of whom shall file the same in his office. Sec. 8. All laws in conflict with the provisions of this Act are hereby repealed. |

________

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 165ê

|

Chap. V.–An Act to provide for the selection and sale of Lands granted by the United States to the State of Nevada.

[Approved April 2, 1867.]

The People of the State of Nevada, represented in Senate and Assembly, do enact as follows:

Section 1. For the purpose of selecting and disposing of the lands granted by the United States to the State of Nevada, including the sixteenth and thirty-sixth sections, and those selected in lieu thereof in accordance with the terms and conditions of the several grants of lands by the United States to the State of Nevada, a State Land Office is hereby created, of which the State Surveyor General shall be ex officio Register. He shall, as such Register, be required to give bonds in the sum of ten thousand dollars for the faithful performance of his duties, which bonds shall be approved by the Governor, and filed in the office of the Secretary of State. The Register shall keep his office at the seat of government, and the same shall be kept open on all legal days, between the hours of nine A.M. and four P.M., for the transaction of business; the rent to be paid by the State. Sec. 2. The Register shall procure copies of the township plats of the public surveys now on file in the United States Land Office in this State, and he may, from time to time, obtain copies of all township plats in the United States Surveyor General’s Office, not on file in said Land Office, and shall procure copies of all township plats of lands within this State subsequently filed in said Land Office, unless the same shall have been previously obtained from the United States Surveyor General’s Office; provided, that the cost of the same shall not exceed five dollars each when on tracing cloth, and shall not exceed eight dollars each when on drawing paper. Sec. 3. The Register shall make and furnish a copy of the plats of townships within any county to the County Surveyor of such county, to be used by him and the Assessor in furnishing such information as the Register may require of them concerning the lands within such townships. Sec. 4. The Register shall, as information may be obtained, report the same to the Board of Regents, who shall, as fast as the interests of the State may require the same, select, as portions of the several grants, the particular tracts to be taken by the State in part satisfaction of such grants; also, as a portion of any such grant, all such tracts as may be designated by individuals who shall have deposited the purchase money therefor, as hereinafter provided, with the State Treasurer. The Register shall, on the first Monday in each month, make out separate lists of the tracts so selected under each grant during the previous month, and certify the same, a copy of which he shall file with the Register of the United States Land Office in the district where such lands are located, and shall keep a record of such lists in his office. He shall open “tract books” according to township and range, in which shall be entered, in proper, regular order, all the lands which shall have been donated selected, approved, and set apart for the benefit of the State; and when applications to purchase are made, the same shall be entered in said books, by giving the number and date of application, name and residence of the applicant, the tract applied for, and price offered; and such applications and completed sales shall be noted on the township plats. |

State Land Office created.

Register ex officio.

To procure copies of township plats.

Proviso.

To furnish copies of plats, etc.

To report information to Board of Regents, etc.

To open tract books. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 166 (CHAPTER 5)ê

|

Records, etc., open to inspection.

Duties of Register and Treasurer when special deposit is made.

Notice of sealed proposals for purchase of lands, etc.

Occupant to have preferred right. |

residence of the applicant, the tract applied for, and price offered; and such applications and completed sales shall be noted on the township plats. All the books, records, plats, and papers in the office of said Register, relating to the location and sale of State lands, shall be open to public inspection during office hours without fee therefor. Sec. 5. Upon the written application of any person to the Register for the location of lands which such person may desire to purchase from the State, accompanied by a certificate of the State Treasurer that said person has made special deposit in his office of the purchase money for such lands, the Register shall include the same in the list of selections for the month. And the State Treasurer is hereby authorized to receive on special deposit, all sums so tendered, and give receipts therefor; and he shall keep a separate account thereof on his books, and said moneys shall not be used or appropriated for any purpose whatever while upon his books as special deposit; but when the contemplated entry can be completed, in whole or in part, upon return of the deposit receipts, the Treasurer shall issue his ordinary receipt for the amount necessary to effect the purchase, and transfer the amount to its proper fund account. If, from the non-approval of the location, or other cause, the whole or any portion of said deposit cannot be applied to the payment for lands originally entered, then, upon return of the deposit receipt, the Treasurer shall refund the proportionate or whole amount of such deposit, to the person entitled thereto, as such person may elect, taking receipt therefor. Sec. 6. The Register shall, on the first Monday of each month, prepare a list containing a brief description of the lands selected during the previous month, in each county, and shall furnish a copy of such list to the County Surveyor, who shall file the same, and also mark them on the township plat in his office. The Register shall also furnish to the County Surveyor of the county wherein such lands are situated, a sufficient number of notices, stating therein that sealed proposals for the purchase of any such lands will be received by the Register, at any time within three months from the date of such notice, and that said proposals will be opened upon the day of the expiration of said three months, at the Register’s office, by the Board of Regents, and when there is no opposing application, the person applying shall be allowed to enter the same; and it shall be the duty of such County Surveyor to properly post such notices within his county. Every such proposal shall state the name, residence and post-office address of the applicant; the description according to their designation upon the United States township plats of the tracts applied for; the number of acres, and the price per acre offered, which shall in no case be less than one dollar and a quarter per acre; and, when the applicant is the occupant or in the possession of such lands, the dates when such occupancy or possession commenced shall be stated under oath. An occupant or party in possession shall have a preferred right to purchase for six months after the selection by the State of the lands occupied or possessed by them, and for the same time shall have the right to purchase one hundred and sixty acres at the minimum price, except it be double minimum land, in which case they shall have the right to purchase the same amount at double minimum price. If the Commissioner of the General Land Office shall decide that the State cannot select lands within the limits of the reservation made for the Pacific Railroad, then the Board of Regents may select one-half the amount of land in satisfaction for the grant to the State, and the price of said land shall not be less than double the minimum price. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 167 (CHAPTER 5)ê

|

faction for the grant to the State, and the price of said land shall not be less than double the minimum price. Sec. 7. When two or more persons, claiming a preferred right to purchase, apply for the same lands, the Register shall certify such applications to the District Court of the county in which such lands are situated, giving the date of each application, and notify the contesting applicants thereof. The Judge or Court shall then appoint a Commissioner in the vicinity of the land so in dispute, to take and report to such Court all the testimony of the parties in the case. The contest shall then be tried and determined as ordinary actions in said Court, and when so determined, shall be certified to the Register, who shall proceed thereafter with the successful contestant, in the same manner as if he alone had applied in the premises; provided, that all costs attending such contest shall be paid by the parties litigant, as the Court or Judge may determine. When two or more persons, neither claiming a preferred right, apply to purchase the same lands, if the prices offered are equal, the first applicant shall be allowed to purchase; if the prices are unequal, the person offering the highest price shall be allowed to purchase; and in case of simultaneous application and equal price, then the Register shall give notice to the contestants that he will receive further sealed proposals from said applicants, and the one offering the highest price shall be allowed to purchase; but if he shall fail to purchase the same for ten days after notice of the acceptance of his proposal, then the next highest bidder shall be allowed to purchase. All lands so advertised as having been selected, which shall not have been applied for within said period of three months, those applied for at any time thereafter for which payment shall not have been made within ten days from the time of application and notice as aforesaid, and those cases of conflict which shall not have been so paid for within six months after the decision of such conflict, shall thereafter be subject to sale by private entry at any time, at the minimum price per acre, upon written application to the Register; provided, that a higher price shall not have been fixed to such lands by the Board of Regents. The minimum price of all such lands is hereby fixed at one dollar and a quarter per acre. The holder of any unlocated land warrant heretofore issued under any law of this State shall be allowed to surrender the same, and such warrant shall be received as in full payment for the number of acres specified in the same. Any person holding warrants above minimum price may surrender the same in exchange for minimum warrants with reference to the relative value which the one shall bear to the other, or may exchange those of minimum value for warrants of greater value; and it is hereby made the duty of the Controller to make such exchange, when applied for by the holders thereof. No person shall be allowed to purchase or locate more than three hundred and twenty acres under the provisions of this Act. Sec. 8. All applications to purchase shall be made in writing, and be signed by the applicant or his agent, and shall designate the tracts applied for, the number of acres, and shall be presented to the Register, who, if there is no valid objection to the sale of the land, shall give to the applicant a certificate, stating the name and residence of the applicant, the designation, number of acres, and price of the tract; and on presentation of such certificate to the Treasurer, he shall receive the purchase money, and receipt for the same in triplicate, one of which shall be filed with the State Controller; and on one of such receipts being filed with the Register, the purchase shall be perfected, and the proper entry as to such sale made upon the books and maps of his office. |

Proceedings when two or more persons claim a preferred right.

Proviso.

When persons apply, neither claiming a preferred right.

When lands subject to sale. Proviso.

Holder of land warrant may surrender same.

Applications to purchase. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 168 (CHAPTER 5)ê

|

Title to be conveyed by patent.

Floating land warrants to be prepared, issued, etc.

Accounts of moneys, etc.

Register to collect fee. |

proper entry as to such sale made upon the books and maps of his office. On the first Monday of each month, the Register shall certify to the Secretary of State an abstract, showing the particulars of all the sales during the previous month. The title of the State to the lands so sold shall be conveyed to the purchaser, or to his heirs or assigns, by patents, free of charge, in such form as the Board of Regents shall prescribe; to be prepared by the Register, signed by the Governor, and shall have the great seal of the State affixed by the Secretary of State, and shall be countersigned by the Register, who, with the Secretary of State, shall keep a record of the patents issued. Sec. 9. The Board of Regents shall prepare blanks for floating land warrants, in compliance with the requirements of the third section of the Eleventh Article of the Constitution of this State, for the location of legal subdivisions of forty, eighty, and one hundred and sixty acres each, which shall be deposited with the Controller, to be issued by him to any applicant who shall deposit a receipt of the State Treasurer showing that such applicant has paid into the State Treasury a sum equal to the amount of purchase money, at the rate of one dollar and a quarter per acre, for the number of acres specified in such warrants; provided, that the Board of Regents shall have power, and it is hereby made their duty to fix the price of any land mentioned in this Act at a higher rate than one dollar and a quarter per acre, when, in their judgment, the interests of the State would be subserved thereby, except as otherwise provided in this Act, in which case warrants shall be issued in accordance with such higher rate. Warrants shall be signed and countersigned, and impressed with the great seal of the State, in the manner prescribed for patents in section nine [eight] of this Act, and records of the warrants shall be kept by the Secretary of State, the Controller and the Register. Such warrants may be located by the warrantee, his heirs or assigns, upon any of the lands granted to the State, in satisfaction of such grant as shall be specified therein; and whenever the legal holder of any such warrants shall desire to locate the same upon lands not already selected for the State, he shall surrender such warrants to the Register, with a designation of the tracts he may desire to locate thereby; and it shall be the duty of the Register, upon ascertaining that such tracts can be legally located in part satisfaction of the grant referred to in the warrants, to give to the party an official receipt for such warrant, specifying the tracts sought to be located thereby, and to include such tracts in his next monthly abstract of locations. Whenever the tracts so selected, shall be finally approved, as State selections by the General Government, then a patent shall be issued in the same manner as hereinbefore provided in relation to patents for lands purchased. And until the patent shall have been issued for the lands located by such warrants, or until it shall have been decided that such lands could not be legally located in satisfaction of such warrants, the said receipt of the Register shall be prima facie evidence of title thereto in the party entitled to such warrants, his heirs and assigns. If the lands so selected shall be finally decided not to be subject to such location, then upon the return of the Register’s said receipt to him the person entitled shall be allowed to make other selections. The appropriate State officers shall keep in their respective offices, under appropriate heads, full and accurate accounts of all moneys received, warrants issued, and the locations thereof. The Register shall collect a fee of one per centum upon the amount of money deposited or paid for land or for warrants from the purchaser under the provisions of this Act, |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 169 (CHAPTER 5)ê

|

purchaser under the provisions of this Act, which shall be used in defraying the expenses incurred under this Act, and the same shall be paid by the Register to the State Treasurer, who shall place such moneys to the credit of the General School Fund of the State. Sec. 10. The Register shall compile from the United States township plats and from maps in the office of the Secretary of State, (who is hereby instructed to allow such maps to be copied) and from maps in the State Surveyor General’s office, and from such other reliable data as he may be able to obtain, a map of this State, which shall, as far as may be practicable, exhibit the topography and geography of the State. He shall also compile a general map exhibiting the position of all lands belonging to the State or applied for under the various grants. The lands of the several grants shall be designated by different colors, and the characteristics and quality of the same shall be indicated as far as may be practicable; which map shall be open to inspection at all times during office hours, free of charge, and a copy of the same shall accompany his report to the Governor, who shall transmit the same to the next Legislature. Sec. 11. The actual occupant who has made improvements on any portion of sections sixteen or thirty-six, prior to the passage of this Act, shall have the preferred right for six months after the passage of this Act, to purchase the same, after which time the same shall (if not previously entered or purchased by such actual settler) be subject to entry by any person desiring the same; provided, that parties settled and residing upon either a sixteenth of thirty-sixth section, before survey, shall have six months after such survey is made in which to purchase. Sec. 12. Lands selected prior to the passage of this Act, in lieu of the sixteenth and thirty-sixth sections, shall be sold as the sixteenth and thirty-sixth sections; provided, that where any person shall have applied to locate school land warrants upon such lands, such person shall have a prior right for thirty days after the passage of the [this] Act, to locate such warrants upon the land he may have applied to make such location upon, in case there be no prior title or claim thereto, under any law of this State. Sec. 13. The sum of six thousand dollars is hereby appropriated from the General Fund and placed at the disposal of the Board of Regents, to be used at their discretion in hastening the survey by the United States Surveyor-General, of meridian, standard, township and section lines, or portions thereof, in such portions of the State as in their judgment will most facilitate a speedy selection and sale of valuable lands by the State. The Board of Regents shall keep a record of such disbursements as shall be made under the provisions of this section of this Act, and preserve vouchers therefor so far as the same may be necessary to obtain from the United States Government reimbursement of sums expended in procuring such surveys to be made. Sec. 14. It shall be the duty of the County Surveyors, when practicable, to obtain authority from the United States Surveyor General to make official surveys in their respective counties, and if called upon by any person desirous of purchasing unsurveyed lands from the State, to survey the same in accordance with instructions from the United States Surveyor-General. Sec. 15. The State Register shall be entitled as such Register to a salary of two thousand six hundred dollars per annum, to be paid quarterly. |

Maps of State to be compiled.

Preferred right to purchase.

Proviso.

Lands selected prior to passage of Act, how sold.

Appropriation to hasten survey.

Duty of Co. Surveyors.

Salary of Register. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 170 (CHAPTER 5)ê

|

Clerk and Draughtsman.

Proviso.

Claims, how audited and paid.

Assignment of Warrant.

Funds, how invested.

Privilege to make payment.

Same.

Proviso. |

quarterly. He may appoint a deputy, but such deputy shall receive no compensation from the State. Sec. 16. When, in the opinion of the Board of Regents, a necessity therefor shall exist, the Register may employ a clerk at a salary not exceeding one hundred and fifty dollars per month; and when, in the opinion of said Board, a like necessity shall exist, he may employ a competent draughtsman at a salary not exceeding two hundred dollars per month; provided, that the salaries of the clerk and draughtsman shall not collectively exceed the sum of two thousand dollars for any one year in the aggregate. Sec. 17. All claims and accounts for services, or for expenses authorized by, and necessarily incurred in carrying out any of the provisions of this Act, shall be presented to, and audited as other claims by the State Board of Examiners, and when any claim shall be passed and allowed by said Board, they shall apportion the same so payable or chargeable to the several funds derived from the sale of lands as they shall deem proper, and so much of the funds received from the sale of lands in the several grants as may be necessary for the payment of such audited claims, shall be, and the same is hereby appropriated out of the several funds respectively, for the payment of such claims, and the Controller shall draw his warrant accordingly. The Board of Examiners are hereby authorized and directed to allow and direct to be paid, such sums to the Register and Receiver of the United States Land Office, respectively, for any official services performed by them in relation to the designation of the selected lands upon the books of their respective offices, as they may be justly entitled to under the laws of the United States, or the instructions of the proper department at Washington City. Sec. 18. The assignment of any land warrant sold under the provisions of this Act shall be signed, sealed and acknowledged in the same manner as conveyances of real estate, before the same shall be located. Sec. 19. All funds derived from the sale of lands under this Act, after deducting the expenses allowed in this Act, shall be invested in interest-bearing bonds of this State, or of the United States, as required by Section three, of the eleventh Article of the Constitution of this State. The proceeds of the sale of lands donated to this State by Act of Congress of July second, 1862, shall be so invested by the Board of Regents; and the proceeds of all other lands herein referred to shall be invested by the State Board of Education. Sec. 20. Parties who have heretofore contracted for the purchase of lands from the State in the sixteenth and thirty-sixth sections, shall have the privilege of making full payment for said land, at any time prior to the maturity of such contract, at the rate contracted for. Sec. 21. Any person or persons in possession of lands heretofore selected by the State in lieu of the sixteenth and thirty-sixth sections, for which school land warrants have not been purchased by him or them, shall have the privilege of purchasing said lands at such rate per acre as the Board of Regents may determine; provided, in cases where persons were in possession of any such lands prior to the time of selection thereof by the State, and waive their right of pre-emption in favor of the State, such person may purchase at the rate of one dollar and a quarter per acre. Sec. 22. In addition to the mode and manner of sale of the lands belonging to the State as hereinbefore authorized, the State Register is hereby further empowered to sell and dispose of any lands in this Act mentioned, |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 171 (CHAPTER 5)ê

|

hereby further empowered to sell and dispose of any lands in this Act mentioned, except timber or wood lands which shall be sold only for cash, payable in installments as hereinafter specified; that is to say, with any party or parties wishing to purchase lands under the provisions of this section, and who shall have made proper application therefor and duly established his, her or their right to purchase under the provisions of this Act, the State Register is hereby authorized and required to enter into contract to sell such lands at such price as the same may be valued for the time being by the proper authority, payable as follows, to wit: one-fifth of the amount to be paid at the time of contract, and the balance in four equal annual installments, with interest at the rate of ten per centum per annum, payable in advance upon all deferred installments. All such contracts shall be entered into in writing with the party or parties so purchasing, in which the condition shall be distinctly expressed that upon a failure to pay the principal and interest thereon as stipulated, the said land shall immediately and unconditionally revert to the State, and be thereafter subject to sale in the same manner and under the same conditions as though no such prior contract and sale had been made. It shall be the duty of the Register to keep a record, in a book kept in his office for that purpose, of all such contracts and sales made under the provisions of this section, which record shall show, in tabular form, the condition of each sale. He shall also certify each sale and terms thereof to the State Treasurer, who shall thereupon receive the payment as specified therein, and when payments are made thereon shall receipt for the same as is provided in section eight of this Act, and when full payment shall have been made patents shall issue to the purchaser, his or her assigns, as in other cases in this Act provided. Sec. 23. All Acts heretofore passed providing for the location, selection, designation or sale of any of the lands granted to this State by the United States are hereby repealed. |

Register empowered to sell certain lands, etc.

Contract.

Contract to be in writing.

Sales to be certified to Treasurer.

Repeal.

|

________

|

Chap. VI.–An Act supplementary to an Act entitled “An Act making appropriations for the support of the Civil Government of the State of Nevada, for the third and fourth fiscal years,” approved March 12th, 1867.

[Approved April 4, 1867.]

The People of the State of Nevada, represented in Senate and Assembly, do enact as follows:

Section 1. The following sums of money are hereby appropriated out of any money in the State Treasury not otherwise appropriated, in addition to the appropriations made by the Act entitled as in the title to this Act specified, that is to say: First-For the rent of the Governor’s office, ($1000) one thousand dollars. Second-For porterage for the Governor’s office, ($480) four hundred and eighty dollars. Third-For the Secretary of State, for copying Journals, third regular, and special the sessions, ($1080) one thousand and eighty dollars. |

Appropriations. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 172 (CHAPTER 6)ê

|

Same. |

Fourth-For porter of Capitol Building, ($1200) twelve hundred dollars. Fifth-For rent of Attorney General’s Office, ($250) two hundred and fifty dollars. Sixth-For Bailiff for Supreme Court, ($1500) fifteen hundred dollars. Seventh-For deficiency in Soldiers’ Fund, ($10,000) ten thousand dollars. Eighth-For incidental expenses of Adjutant General’s Office, to be expended as now provided by law, under the Board of Military Auditors, ($500) five hundred dollars. Ninth-For expenses of procuring the title to the Plaza in the City of Carson, ($50) fifty dollars. All expenses paid out of the appropriations provided for by this Act, and by the Act to which this is supplementary, shall be reported to the next session of the Legislature, in an itemized account, by the officer incurring the same. |

________

|

Public administrators to be elected. Coroner. Oath and bond.

Oath.

Proviso.

New or additional bond. |

Chap. VII.–An Act concerning the Office of Public Administrators, and the Estates of Deceased Persons.

[Approved April 4, 1867.]

The People of the State of Nevada, represented in Senate and Assembly, do enact as follows:

Section 1. There shall be elected in each organized county of this State, at the general election in A.D. 1868, and each alternate year thereafter, a Public Administrator, who shall be ex officio Coroner in and for his county. Each Public Administrator hereafter elected shall take the Constitutional official oath, and give such official bond as shall be, in amount, required and fixed by an order duly entered upon their journal of proceedings by the Board of Commissioners of the county, to be conditioned, secured, approved, filed, and recorded as the bonds of other county officers are, or may be required by law to be; and shall be so conditioned as to hold the principal and sureties liable for any breach thereof made while acting, or illegally refusing to act, in either official capacity. The official oath shall be for the faithful performance of the duties of both offices, and shall be taken and subscribed upon both the certificate of election (or appointment, if appointed to fill a vacancy, as hereinafter provided) and the official bond; and that upon the bond shall be recorded with it; provided, the official bond of no Public Administrator shall be less than two thousand dollars; and, provided further, that the County Commissioners may, upon reasonable cause therefor shown, require, at any time, a new bond or an additional bond to be given, upon ten days’ notice in writing; and if not so given, shall thereupon declare the office vacant, and fill the vacancy by appointment for the remainder of the term; and shall, in like manner, fill a vacancy in said office arising from any other cause. Any person appointed to the office of Public Administrator shall, within ten days thereafter, qualify in the same manner as if elected thereto. Every person elected to fill said office shall qualify as in this section required, on or before the first Monday of January next after his election, and shall on that day enter upon the discharge of his official duties. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 173 (CHAPTER 7)ê

|

Sec. 2. The Public Administrator of each county shall have the right, and it is hereby made his duty, to administer according to law, upon the estate of any person who died intestate in, or was at the time of his or her death, a resident of the county, or had assets therein, not administered on in some other county, or of a deceased stranger, or of a deceased testate, when no executor is appointed, or if appointed, fails to qualify; unless administered upon within one month after death of the testate, or within the time provided by law for an intestate, by a relative, by blood or marriage, within the fourth degree of consanguinity or legal relation. For such administration, he shall be paid as other administrators or executors are paid. Sec. 3. Each Public Administrator shall, on the first Monday in January and July in each year, and at the termination of his official duties, make a verified written report to the District Judge having jurisdiction in the premises, of all estates of deceased persons which have officially passed into his hands, the value of the same, the expenses, if any, paid thereon, and the balance of property, effects, or money, if any, remaining in his hands; and the Judge to whom such report is made shall cause it to be made public, by publication or by posting, as he may deem just and right. Sec. 4. Each executor, administrator, and public administrator, on final settlement of an estate and proper order of the Court having jurisdiction in the matter thereof, or before final settlement upon the regular order of the Court aforesaid, shall pay over all moneys of such estate to the lawful heirs, or legatees, or devisees thereof, and if there be none of either, then to the County Treasurer; and the County Treasurer shall pay the same to the State Treasurer; and if the same be escheated to the State, the State Treasurer shall place the same in the fund devoted and pledged to educational purposes. Sec. 5. No Public Administrator shall be interested, in any wise, in any expenditures of any kind, made on account of any estate of a deceased person, upon which he is administering, save as necessarily made in the due course of such administration; nor shall he be associated in business with any one so interested; and he shall state in his semi-annual reports that he has not been so interested or associated. Sec. 6. For any willful misdemeanor in office any Public Administrator may be indicted, tried, and, if found guilty, fined in any sum not exceeding two thousand dollars, and removed from office; but such fine and removal shall not bar any existing right of civil action upon his official bond. Sec. 7. It shall be the duty of all persons, especially of all civil officers, to give all information in their possession to Public Administrators respecting estates, and the property and condition thereof, upon which no other person has then administered. Public Administrators may, and it is hereby made their official duty to institute, maintain, and prosecute all necessary actions, at law and in equity, for the recovery and for the protection of the property, debts, papers, or other estate of any deceased person upon whose estate they may be administering. Sec. 8. Except as in this Act otherwise provided, Public Administrators in administering upon estates shall be governed by the same rules and laws by which other administrators or executors are. Sec. 9. Public Administrators, when acting ex officio as Coroners, shall be governed by the same laws by which Justices of the Peace have been, when so acting; and shall receive the same fees allowed heretofore for such services. |

Duty to administer.

How paid.

To make verified report to District Judge.

To pay over money on order of Court, etc.

Not to be interested in expenditures.

Penalty for misdemeanor in office.

Information to be given to Public Administrators respecting estates, etc.

How governed.

How governed, when acting as Coroner. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 174 (CHAPTER 7)ê

|

May qualify, as provided in this Act.

Money paid into the State Treasury, how recovered.

Proviso.

Costs. When money placed in School Fund.

Not required to make formal application for letters, etc.

Repeal. |

Sec. 10. The Public Administrators elected on the sixth day of November, one thousand eight hundred and sixty-six, may qualify, as provided in this Act, within thirty days after its approval; and they shall, immediately after so qualifying, enter upon the discharge of their official duties, and shall continue in office until the first Monday in January, eighteen hundred and sixty-nine, and thereafter, until their successors shall have been duly elected and qualified. Sec. 11. Any money paid into the State Treasury under the provisions of this Act, excepting from an escheated estate, may be recovered the rightful heirs or legatees thereof in the following manner: such heir or heirs, legatee or legatees, may present their claim therefor to the District Court which had jurisdiction of the final settlement of the estate to which such money belonged, and make proof of the validity of such claim, after notice given to the Attorney General of the State, to the satisfaction of such Court under such rules as it may prescribe. If satisfied on the hearing that such claimant or claimants are rightfully entitled to the same, the Court shall enter a decree that such money be paid to him or them; such decree shall then be certified to the State Board of Examiners, stating the amount thereby found to be due, and the said Board shall allow the same, certify it to the Controller, who shall draw his warrant therefor on the Treasurer, who shall pay the same; provided, no proceedings shall be maintained under the provisions of this section of this Act, unless commenced within two years next after the final settlement of the estate to which they relate; and, provided further, that all costs of such proceedings shall be paid by the applicant or applicants. If not applied for within two years as above provided, or if applied for and not obtained, such moneys shall then be placed in the irreducible school fund of the State. Sec. 12. Public Administrators are authorized to administer on the estates of any deceased person in any case where by law he is entitled to administration by virtue of his office, and shall not be required to make formal application for letters of administration; nor shall he be required to file or have approved any bond except as such public administrator, in any case; provided, that the bonds of any public administrator may be increased as provided in this or other Acts. Sec. 13. All Acts and parts of Acts, so far only as they conflict with the provisions of this Act, are hereby repealed. |

________

|

Contingent expenses, how paid. |

Chap. VIII.–An Act providing for the payment of the Contingent and other necessary expenses of the third General, and the Special Sessions of the Legislature of the State of Nevada.

[Approved April 10, 1867.]

The People of the State of Nevada, represented in Senate and Assembly, do enact as follows:

Section 1. The Contingent and other necessary expenses of the Third Session of the Legislature of the State of Nevada, and of the present Special Session of said Legislature, are hereby directed to be audited and paid out of the Legislative Funds of said General and Special Sessions. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 175 (CHAPTER 8)ê

|

present Special Session of said Legislature, are hereby directed to be audited and paid out of the Legislative Funds of said General and Special Sessions. Should there be any deficiency in said Legislative Funds, to pay all the expenses aforesaid, the balance not so paid, shall be audited and paid out of the General Fund of the State. |

Deficiency. |

________

|

Chap. IX.–An Act amendatory of and supplementary to an Act, entitled “An Act prescribing rules and regulations for the execution of the trust arising under the Act of Congress, entitled ‘An Act for the relief of citizens of towns, upon lands of the United States, under certain circumstances, approved May 23d, 1844,’ ” approved January 31st, 1866.

[Approved April 10, 1867.]

The People of the State of Nevada, represented in Senate and Assembly, do enact as follows:

Section 1. Section one of said Act is hereby amended, so as to read as follows: Section One. When the corporate authorities of any town, or the Judge of the District Court for any county or district in this State, in which any town may be situate, shall have entered at the proper Land Office, the land, or any part of the land settled and occupied as the site of such town, pursuant to, and by virtue of the laws of the United States in such case made and provided, now in force or hereafter to be enacted, it shall be the duty of such corporate authorities or Judge, as the case may be, to dispose of and convey the title to such lands, or to the several blocks, lots, parcels or shares thereof, to the persons hereinafter specified. Sec. 2. Section two of said Act is hereby amended, so as to read as follows: Section Two. Any such corporate authorities or Judge holding the title to any such land in trust, as declared in any Act of Congress now in force, or hereafter to be enacted, shall, by a good and sufficient deed of conveyance, grant and convey the title to each and every block, lot, share or parcel of the same, to the person or persons who shall have, possess, or be entitled to the right of possession or occupancy thereof, according to his, her, or their several and respective right or interest in the same, as they existed in law or equity, at the time of the entry of such lands, or to his, her, or their heirs or assigns; and when any parcel or share of such lands shall be occupied or possessed by one or more persons claiming the same by grant, lease or sale from one or more other persons, the respective right and interest of such persons in relation to each other, in the same, shall not be changed or impaired by any such conveyance. Every deed of conveyance to be made by such corporate authorities or Judge, pursuant to the provisions of this Act, shall be so executed and acknowledged, as to admit the same to be recorded. |

Authorities, after entry of land, to convey title, etc.

To be conveyed to person having equitable title at time of entry.

Rights of persons not to be impaired.

Deed to be executed so as to admit same to record. |

…………………………………………………………………………………………………………………

ê1867 Statutes of Nevada, 1st Special Session, Page 176 (CHAPTER 9)ê

|

Deed to be made on payment of proportion of purchase money and expenses.

Compensation.

Trustees may discharge trust after going out of office.

When successor may execute trust.

Provisions of Acts to apply to all corporations, etc. |

Sec. 3. Section seven of said Act is hereby amended, so as to read as follows: Section Seven. After the issuance of the patent for such lands it shall be the duty of the corporate authorities or Judge to whom such patent shall issue, to make out, execute and deliver to each person who may be legally entitled to the same, a deed in fee simple for such part or parts, lot or lots of land on payment of his proper and due proportion of the purchase money for such land, together with his proportion of such sum as may be necessary to pay for streets, alleys, squares, and public grounds, not exceeding twenty-five cents for each lot, and also such further sums as shall be a reasonable compensation for prepaying, executing and acknowledging such deed, not exceeding the sum of three dollars for the first, and fifty cents for each additional lot claimed by the same owner, for counsel fee and for moneys expended in the acquisition of the title, and the administration of the trust, including reasonable charges for time and services employed in such trust, not exceeding the sum of fifty cents for each lot, and the foregoing charges shall be full payment for all expenses attending the execution of the trust, except Revenue Stamps. Sec. 4. Section nine of said Act is hereby amended, so as to read as follows: Section Nine. Any corporate authorities or Judge becoming a trustee under any Act of Congress now in force, or hereafter to be enacted, relating to the relief of citizens of towns upon lands of the United States, who shall, prior to the final execution of their trust, as provided in this Act, go out of office, shall be authorized, and they are hereby empowered to discharge and execute all trusts which they may have assumed, in all respects in the same manner and subject to the same duties and requirements as in the first instance. Sec. 5. Section ten of said Act is hereby amended, so as to read as follows: Section Ten. In case of death, removal from the State, or other disability of the trustee to execute the trust created by any Act of Congress now in force, or hereafter to be enacted as provided in this Act, it shall be lawful for the corporate authorities or Judge of the district or county in which any such town is situated who may succeed said trustee in office, to assume said trust; and they or he shall be authorized, and they are hereby empowered, to execute the same, in all respects in the same manner, subject to all the duties and requirements as provided in this Act. Sec. 6. The provisions of this Act, and the Act of which it is amendatory and supplementary, shall be deemed to apply to all corporations, associations, city, town, or State authorities, with like effect to claim, hold, and acquire the title to property possessed for corporate or public purposes, for such corporate or public uses, to the same extent and benefit as a person or persons, as provided in the aforesaid Acts. |