[Rev. 8/6/2022 5:42:32 PM]

[NAC-82 Revised Date: 9-14]

CHAPTER 82 - NONPROFIT CORPORATIONS

GENERAL PROVISIONS

82.005 Electronic filing of records.

82.010 Considerations in determining whether proposed name of nonprofit corporation is distinguishable from name of existing business entity.

SOLICITATION OF CHARITABLE CONTRIBUTIONS

82.200 “Contribution, donation, gift or the like” and “solicit” and “solicitation” defined; “executive personnel” interpreted.

82.205 Purpose for which corporation is organized; “fewer than 15 persons” interpreted; determination of relationships within third degree of consanguinity or affinity.

82.210 Registration with Secretary of State: Form; financial report.

82.215 Exemption from requirements for registration and filing.

ANNUAL LIST

82.300 Definitions.

82.310 “Alternative due date” defined.

82.320 “Due date” defined.

82.330 Selection of alternative due date for filing annual list: Form; contents.

82.340 Selection of alternative due date by foreign nonprofit corporation in terminated status.

82.350 Form for selection of alternative due date to be submitted with annual list; deadline for submission.

82.360 Acceptance and filing of form for selection of alternative due date and annual list.

82.370 Notice to registered agent of intent to select alternative due date.

82.380 Limitation on selection of alternative due date; exception.

FOREIGN NONPROFIT CORPORATIONS: PENALTY FOR FAILURE TO COMPLY WITH REQUIREMENTS FOR QUALIFICATION

82.400 Activities subject to fine.

82.405 Filing of complaints.

82.410 Duties of Secretary of State upon receipt of complaint.

82.415 Determination regarding sufficiency of complaint: Notice of deficiencies; demand for response; referral for legal proceedings.

GENERAL PROVISIONS

NAC 82.005 Electronic filing of records. (NRS 82.525)

1. The Secretary of State may develop or approve an electronic process for the electronic filing of records authorized or required to be filed with the Secretary of State pursuant to chapter 82 of NRS.

2. If the Secretary of State has developed or approved an electronic process and the electronic process is in place and available for use in the Office of the Secretary of State:

(a) A person may use the electronic process to file with the Secretary of State any record authorized or required to be filed with the Secretary of State pursuant to chapter 82 of NRS; and

(b) The Secretary of State will accept a record filed with the Secretary of State through the use of the electronic process if the record contains all the information required for filing and is accompanied by the appropriate fee and any applicable penalty.

3. The Secretary of State may reject a record filed with the Secretary of State through the use of an electronic process developed or approved by the Secretary of State if:

(a) The statutory requirements for filing the record have not been satisfied;

(b) The appropriate fee has not been submitted;

(c) The information contained in the record has been corrupted in any manner; or

(d) The record contains a virus or may otherwise compromise the security of the electronic process.

4. Failure by the Secretary of State to receive a record filed through the use of an electronic process does not relieve the person who attempted to file the record from any requirement to file the record, pay the appropriate fee or incur an applicable penalty.

5. As used in this section:

(a) “Electronic filing” means the submission of records to the Secretary of State by an electronic process and the processing of such records by the Secretary of State by an electronic process.

(b) “Electronic process” means any electronic process for the electronic filing of records authorized or required to be filed with the Secretary of State pursuant to chapter 82 of NRS.

(Added to NAC by Sec’y of State by R068-11, eff. 12-30-2011)

NAC 82.010 Considerations in determining whether proposed name of nonprofit corporation is distinguishable from name of existing business entity. (NRS 82.096) To determine whether a proposed name of a nonprofit corporation is distinguishable from the name of an existing business entity, the Secretary of State will consider, without limitation, the rules set forth in NAC 78.020 to 78.100, inclusive.

(Added to NAC by Sec’y of State by R098-00, eff. 9-25-2000)

SOLICITATION OF CHARITABLE CONTRIBUTIONS

NAC 82.200 “Contribution, donation, gift or the like” and “solicit” and “solicitation” defined; “executive personnel” interpreted. (NRS 82.417) For the purposes of NRS 82.392:

1. “Contribution, donation, gift or the like” means the actual receipt of, or promise to pay or grant, money or an item of value, including, without limitation, a tangible good or asset, real property, a product or a service.

2. “Solicit” or “solicitation” shall be deemed not to include a request for the payment of bona fide fees, dues or assessments by members of an organization, provided membership is not conferred solely as consideration for making a contribution or donation in response to a solicitation.

3. The Secretary of State will interpret “executive personnel” to mean one or more persons, whether paid or volunteer, at the highest level of management of the corporation who has or have the day-to-day responsibilities for the management of the corporation, including, without limitation, responsibilities for policy making, planning and implementation, decision making, fundraising, supervising paid and volunteer staff, budget management, reporting and accountability, and working with the board of directors.

(Added to NAC by Sec’y of State by R068-13, 12-23-2013, eff. 1-1-2014)

NAC 82.205 Purpose for which corporation is organized; “fewer than 15 persons” interpreted; determination of relationships within third degree of consanguinity or affinity. (NRS 82.417) For the purposes of NRS 82.392:

1. The Secretary of State will deem the purpose for which a corporation is organized, as required information pursuant to paragraph (d) of subsection 3 of that section, to be the same as the purpose set forth in the corporation’s original articles of incorporation or amended articles of incorporation, as applicable.

2. The Secretary of State will interpret “fewer than 15 persons,” as used in paragraph (b) of subsection 7 of that section, to mean that not more than 14 persons are solicited during each year for which the corporation files an annual list as required by subsection 3 of NRS 82.193.

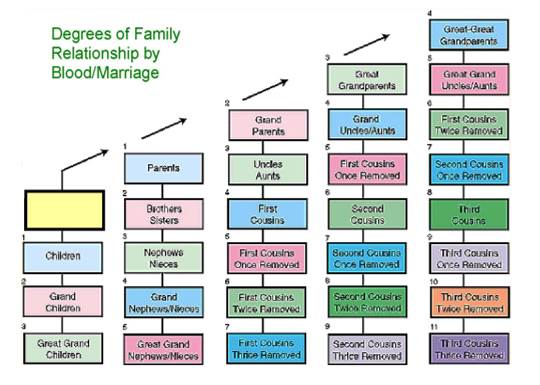

3. The Secretary of State will determine relationships within the third degree of consanguinity or affinity pursuant to the following chart and instructions:

|

Consanguinity/Affinity Chart

INSTRUCTION:

For Consanguinity (relationship by blood) calculations:

Place the officers, directors, trustees or executive personnel for whom you need to establish relationships by consanguinity in the blank box. The labeled boxes will then list the relationship by title to the officers, directors, trustees or executive personnel and the degree of distance from the officers, directors, trustees or executive personnel. Anyone in a box numbered 1, 2 or 3 is within the third degree of consanguinity.

For Affinity (relationship by marriage) calculations:

Place the spouse of the officers, directors, trustees or executive personnel for whom you need to establish relationships by affinity in the blank box. The labeled boxes will then list the relationship by title to the spouse and the degree of distance from the officers, directors, trustees or executive personnel by affinity. A husband and wife are related in the first degree by marriage. For other relationships by marriage, the degree of relationship is the same as the degree of underlying relationship by blood. |

(Added to NAC by Sec’y of State by R147-13, eff. 3-28-2014)

NAC 82.210 Registration with Secretary of State: Form; financial report. (NRS 82.417)

1. The form prescribed by the Secretary of State pursuant to NRS 82.392 may offer a corporation the option of:

(a) Providing the Internet address of a website which may be accessed via the Nevada Business Search web page on the Internet website of the Secretary of State. The Internet address provided by the corporation must be:

(1) The official website of the corporation; and

(2) Kept active and maintained by the corporation.

(b) Certifying that all funds received by the corporation will be used in compliance with the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act (USA PATRIOT ACT) of 2001, Public Law 107-56.

2. For the purpose of providing the financial information required by NRS 82.392 and 82.397:

(a) A corporation which intends to solicit charitable contributions must provide on the form prescribed by the Secretary of State pursuant to NRS 82.392 the following information as reported to the Internal Revenue Service for the most recent fiscal year:

(1) Total revenue, as reported on line 12 of Form 990 or on line 9 of Form 990-EZ;

(2) Total expenses, as reported on line 18 of Form 990 or on line 17 of Form 990-EZ;

(3) Revenue less expenses, as reported on line 19 of Form 990, or excess (or deficit) for the year, as reported on line 18 of Form 990-EZ;

(4) Total assets, as reported on line 20 of Form 990 or on line 25 of Form 990-EZ;

(5) Total liabilities, as reported on line 21 of Form 990 or on line 26 of Form 990-EZ; and

(6) Net assets or fund balances, as reported on line 22 of Form 990 or on line 27 of Form 990-EZ.

(b) If a corporation is not required to file a Form 990 or Form 990-EZ, but filed a Form 990-N or was first formed within the past year and does not have any financial information available, the corporation must check the box provided on the form prescribed by the Secretary of State to indicate that the corporation is providing good faith estimates based on the records of the corporation.

3. The form prescribed by the Secretary of State pursuant to NRS 82.392 must be signed under penalty of perjury by the person who provided the information contained in the form stating that the information is true and accurate to the best of the person’s knowledge.

(Added to NAC by Sec’y of State by R068-13, 12-23-2013, eff. 1-1-2014; A by R147-13, 3-28-2014)

NAC 82.215 Exemption from requirements for registration and filing. (NRS 82.417)

1. A corporation which solicits or intends to solicit charitable contributions as defined in paragraph (b) of subsection 7 of NRS 82.392 may claim an exemption from the requirements of that section as they pertain to registration and filing if:

(a) The corporation:

(1) Meets the criteria to qualify as a religious organization pursuant to 26 U.S.C. § 501(c) and any federal regulations relating thereto;

(2) Solicits a total of not more than 14 persons during each year for which the corporation files an annual list as required by subsection 3 of NRS 82.193; or

(3) Directs solicitations only to persons who are related within the third degree of consanguinity or affinity to the officers, directors, trustees or executive personnel of the corporation.

(b) The corporation files a statement of exemption on a form prescribed by the Secretary of State.

2. A statement of exemption must:

(a) Specify the reason for the exemption; and

(b) Be filed at the time the corporation files its initial or annual list pursuant to subsection 3 of NRS 82.193.

3. The form for a statement of exemption must include, without limitation:

(a) The name of the corporation as filed with the Secretary of State;

(b) The exact name of the corporation as registered with the Internal Revenue Service, if different from that registered with the Secretary of State;

(c) The federal tax identification number of the corporation;

(d) The tax exempt status of the corporation;

(e) A provision allowing the corporation to indicate one or more of the reasons for exemption as set forth in subsection 1; and

(f) The signature of an officer of the corporation certifying, under penalty of perjury, that the information contained in the statement of exemption is true, complete and accurate.

(Added to NAC by Sec’y of State by R147-13, eff. 3-28-2014)

ANNUAL LIST

NAC 82.300 Definitions. (NRS 82.523) As used in NAC 82.300 to 82.380, inclusive, unless the context otherwise requires, the words and terms defined in NAC 82.310 and 82.320 have the meanings ascribed to them in those sections.

(Added to NAC by Sec’y of State by R078-13, eff. 12-23-2013)

NAC 82.310 “Alternative due date” defined. (NRS 82.523) “Alternative due date” means the date selected by a foreign nonprofit corporation pursuant to NAC 82.330 on which the list required by subsection 1 of NRS 82.523 must be filed with the Secretary of State each year.

(Added to NAC by Sec’y of State by R078-13, eff. 12-23-2013)

NAC 82.320 “Due date” defined. (NRS 82.523) “Due date” means the date on which the list required by subsection 1 of NRS 82.523 must be filed with the Secretary of State each year as set forth in NRS 82.523.

(Added to NAC by Sec’y of State by R078-13, eff. 12-23-2013)

NAC 82.330 Selection of alternative due date for filing annual list: Form; contents. (NRS 82.523)

1. A foreign nonprofit corporation may select the last day of a month other than the month in which the foreign nonprofit corporation’s due date occurs as the alternative due date for filing the list required by subsection 1 of NRS 82.523 by submitting to the Secretary of State a form prescribed by the Secretary of State which must include, at a minimum:

(a) The name of the foreign nonprofit corporation;

(b) The business identification number assigned to the foreign nonprofit corporation by the Secretary of State;

(c) A statement that the foreign nonprofit corporation desires to select an alternative due date;

(d) The month in which the alternative due date will occur;

(e) A declaration under penalty of perjury that:

(1) The information provided in the form is true and correct to the best of the foreign nonprofit corporation’s knowledge;

(2) The selection of an alternative due date is not being made to avoid any fee or penalty; and

(3) The foreign nonprofit corporation acknowledges that pursuant to NRS 239.330, it is a category C felony to knowingly offer any false or forged instrument for filing with the Office of the Secretary of State; and

(f) The printed name and signature of the person submitting the form and the date on which the form was signed.

2. The alternative due date selected pursuant to subsection 1 must occur before the foreign nonprofit corporation’s next due date. The selection of an alternative due date cannot have the effect of extending a foreign nonprofit corporation’s due date.

3. The selection of an alternative due date pursuant to this section will not result in the proration of any fees or penalties.

(Added to NAC by Sec’y of State by R078-13, eff. 12-23-2013)

NAC 82.340 Selection of alternative due date by foreign nonprofit corporation in terminated status. (NRS 82.523)

1. If a foreign nonprofit corporation is in terminated status, the foreign nonprofit corporation must have its right to transact business in this State restored before it may select an alternative due date pursuant to NAC 82.330.

2. As used in this section, “terminated status” means any status in the records of the Office of the Secretary of State which indicates that a foreign nonprofit corporation no longer has the right to transact business in this State, including, without limitation, the status of “revoked,” “permanently revoked,” “dissolved,” “cancelled,” “terminated,” “administrative hold” or “withdrawn.”

(Added to NAC by Sec’y of State by R078-13, eff. 12-23-2013)

NAC 82.350 Form for selection of alternative due date to be submitted with annual list; deadline for submission. (NRS 82.523) If a foreign nonprofit corporation is selecting an alternative due date pursuant to NAC 82.330, the foreign nonprofit corporation must submit the form for the selection of an alternative due date along with the list required pursuant to subsection 1 of NRS 82.523 on or before the last day of the month immediately preceding the month in which the foreign nonprofit corporation’s due date occurs.

(Added to NAC by Sec’y of State by R078-13, eff. 12-23-2013)

NAC 82.360 Acceptance and filing of form for selection of alternative due date and annual list. (NRS 82.523) Except as otherwise provided in NAC 82.380, the Secretary of State will accept and file a form for the selection of an alternative due date and the list required pursuant to subsection 1 of NRS 82.523 that a foreign nonprofit corporation submits pursuant to NAC 82.350 if:

1. The form contains all the information required pursuant to NAC 82.330; and

2. The list satisfies all filing requirements set forth in NRS 82.523.

(Added to NAC by Sec’y of State by R078-13, eff. 12-23-2013)

NAC 82.370 Notice to registered agent of intent to select alternative due date. (NRS 82.523) A foreign nonprofit corporation shall notify its registered agent of its intent to select an alternative due date not later than 60 days before the alternative due date.

(Added to NAC by Sec’y of State by R078-13, eff. 12-23-2013)

NAC 82.380 Limitation on selection of alternative due date; exception. (NRS 82.523)

1. Except as otherwise provided in subsection 2, the Secretary of State may limit the number of times a foreign nonprofit corporation can select an alternative due date.

2. The Secretary of State may allow for additional selections of an alternative due date beyond any limit imposed by subsection 1 in extenuating circumstances.

(Added to NAC by Sec’y of State by R078-13, eff. 12-23-2013)

FOREIGN NONPROFIT CORPORATIONS: PENALTY FOR FAILURE TO COMPLY WITH REQUIREMENTS FOR QUALIFICATION

NAC 82.400 Activities subject to fine. (NRS 82.5234)

1. The Secretary of State may refer the matter to the district attorney of the county in which a foreign nonprofit corporation has its principal place of business or the Attorney General, or both, for a determination of whether to institute proceedings to recover the fine set forth in NRS 82.5234 if the foreign nonprofit corporation:

(a) Is doing business in this State but has willfully failed to qualify to do business in this State in accordance with the laws of this State; or

(b) Is doing business in this State while the foreign nonprofit corporation is in terminated status.

2. As used in this section, “terminated status” means any status in the records of the Office of the Secretary of State which indicates that a foreign nonprofit corporation no longer has the right to transact business in this State, including, without limitation, the status of “revoked,” “permanently revoked,” “dissolved,” “cancelled,” “terminated” or “withdrawn.”

(Added to NAC by Sec’y of State by R070-11, eff. 5-30-2012; A by R080-13, 12-23-2013)

NAC 82.405 Filing of complaints. (NRS 82.5234)

1. A person may report to the Secretary of State that a foreign nonprofit corporation may be subject to the fine set forth in NRS 82.5234 by emailing a complaint to blcompliance@sos.nv.gov or by mailing a complaint to:

Secretary of State

Commercial Recordings Division

Attn: Business Compliance

202 North Carson Street

Carson City, Nevada 89701

2. A complaint filed with the Secretary of State pursuant to subsection 1 must be on a form prescribed by the Secretary of State and must include, without limitation:

(a) The name, street address, telephone number and, if applicable, the electronic mail address and any other contact information of the complainant;

(b) The name, street address, telephone number and, if applicable, the electronic mail address and any other contact information of any person authorized by the complainant to file the complaint on behalf of the complainant;

(c) The name, street address, telephone number and, if applicable, the electronic mail address and any other contact information of the foreign nonprofit corporation alleged to be subject to the fine set forth in NRS 82.5234;

(d) Information identifying all persons involved in the alleged conduct subjecting the foreign nonprofit corporation to the fine set forth in NRS 82.5234, including, without limitation, the names, street addresses, business locations, telephone numbers, electronic mail addresses and Internet websites of the persons involved in the alleged conduct;

(e) Information identifying the nature of the business engaged in by the foreign nonprofit corporation alleged to be subject to the fine set forth in NRS 82.5234;

(f) Information identifying any other regulatory entity or agency or any court, arbitrator or other tribunal with which the complainant has filed a complaint or report regarding the same conduct, including, without limitation, the name and address of the regulatory entity, agency, court, arbitrator or tribunal, the date upon which any complaint or report was filed and the case number assigned to the complaint or report, if any;

(g) Any additional information which the complainant believes may assist in the investigation of the allegations made in the complaint;

(h) Copies of any documents which the complainant believes may assist in the investigation of the allegations made in the complaint;

(i) A statement indicating whether the complainant is willing to testify regarding the complaint in a court of law or administrative proceeding; and

(j) A statement that to the best of the complainant’s knowledge the information contained in the complaint is true and correct.

(Added to NAC by Sec’y of State by R070-11, eff. 5-30-2012)

NAC 82.410 Duties of Secretary of State upon receipt of complaint. (NRS 82.5234)

1. Upon receiving a complaint filed pursuant to NAC 82.405, the Secretary of State will:

(a) Review the complaint and any information submitted with the complaint;

(b) Determine whether the allegations in the complaint may be addressed through the administrative processes of the Office of the Secretary of State; and

(c) Determine whether to refer the complaint to another regulatory or enforcement agency of this State, a political subdivision of this State, another state or the Federal Government.

2. The Secretary of State may refer a complaint filed pursuant to NAC 82.405 and any information obtained by the Secretary of State through an investigation of the complaint to another regulatory or enforcement agency of this State, a political subdivision of this State, another state or the Federal Government.

3. The Secretary of State may request that the complainant or the foreign nonprofit corporation alleged to be subject to the fine set forth in NRS 82.5234 provide any information deemed necessary by the Secretary of State to assist in the investigation of the allegations made in the complaint.

(Added to NAC by Sec’y of State by R070-11, eff. 5-30-2012)

NAC 82.415 Determination regarding sufficiency of complaint: Notice of deficiencies; demand for response; referral for legal proceedings. (NRS 82.5234)

1. If the Secretary of State determines that the information provided with a complaint filed pursuant to NAC 82.405 is not sufficient to warrant further investigation or processing of the complaint, the Secretary of State will send to the complainant written notification of the deficiencies in the complaint.

2. If the Secretary of State determines that the information provided with a complaint filed pursuant to NAC 82.405 or obtained during the course of an investigation of another matter is sufficient to warrant further investigation or processing, the Secretary of State may send a written demand for a response to the complaint or investigation to the foreign nonprofit corporation alleged to be subject to the fine set forth in NRS 82.5234.

3. A response demanded pursuant to subsection 2 must be:

(a) Completed and returned to the Office of the Secretary of State within the time specified in the written demand; and

(b) Signed under oath by a person in a position of responsibility with the respondent.

4. If, based on the information submitted with a complaint, any information obtained during an investigation of the complaint and any information included in a response demanded pursuant to subsection 2, the Secretary of State determines that a foreign nonprofit corporation is subject to the fine set forth in NRS 82.5234, the Secretary of State may demand that the foreign nonprofit corporation file any document required to bring the foreign nonprofit corporation into compliance with the laws of this State and pay any fee, penalty or fine required by the laws of this State.

5. If, in response to the demand of the Secretary of State pursuant to subsection 4, the foreign nonprofit corporation does not file a document required to bring the foreign nonprofit corporation into compliance with the laws of this State or pay any fee, penalty or fine required by the laws of this State, the Secretary of State may refer the matter to the district attorney of the county in which the foreign nonprofit corporation has its principal place of business or the Attorney General, or both, and request that the district attorney or Attorney General institute legal proceedings to require the foreign nonprofit corporation to file any document required to bring it into compliance with the laws of this State and to pay any fee, penalty or fine required by the laws of this State.

6. The Secretary of State may communicate any findings made or actions taken in response to a complaint or the investigation of a complaint to:

(a) The complainant at the address provided on the complaint form; and

(b) The foreign nonprofit corporation which is alleged to be subject to the fine set forth in NRS 82.5234 at the last known address of the foreign nonprofit corporation or through the foreign nonprofit corporation’s registered agent of record.

(Added to NAC by Sec’y of State by R070-11, eff. 5-30-2012)